Fireside Chat with Patrick Kofler @ Zalando

Perspectives on doing investor relations from DAX40 company

Patrick is head of investor relations at Zalando, one of Germany’s most prominent listed companies focused on online fashion in Europe. Patrick is also on the board of DIRK (German IR Society), which is responsible for promoting best practices in investor relations in Germany.

During the a recent conference in Wrocław, I had a chance to interview him and discuss various aspects of how investor relations are done in his company.

What can we learn from how things are done in this company?

Here are some of my notes from my conversation:

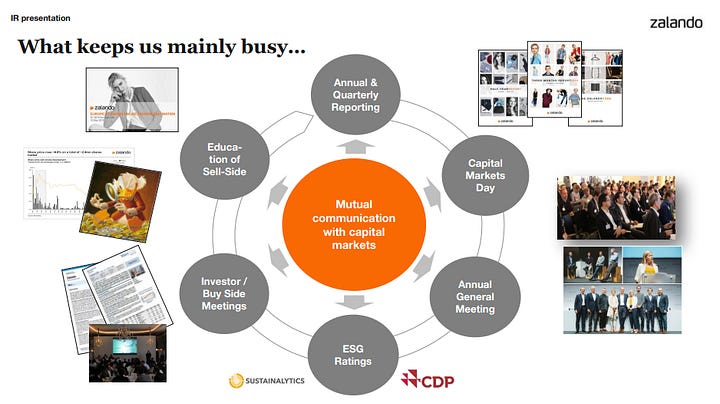

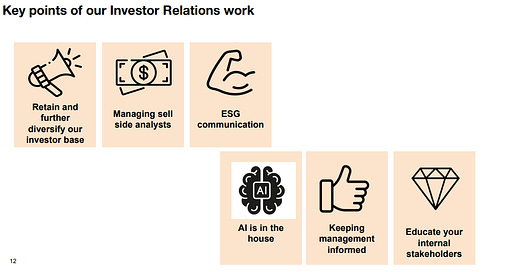

1/ Patrick strongly believes in the significance of maintaining relationships with capital market participants. He feels frustrated when meetings lack genuine interest in the company and are attended with an attitude of "let's just take the meeting to avoid missing something," especially when web cams are turned off during virtual meetings, leaving the IR team speaking to a blank screen.

2/ Patrick stresses that investing time with investors or analysts, both online and offline, not only provides them with necessary information for their investment process but also helps build trust. This trust is valuable in the long run. For instance, a large fund that recently sold part of their stock reached out to Patrick with an explanation, feedback that would have been difficult to obtain without the established relationship.

3/ Managing internal relationships is as important as those with the outside world. Patrick discussed how much time and effort he spent post IPO ensuring the management team and other internal stakeholders understand the value of the investor relations functions and helping answer the question ‘What is Investor Relations really for?’.

4/ Continually educating sell-side is a key pillar of Zalando’s IR strategy. The company is covered by over 30 sell-side analysts, with not all analysts are equally engaged with the company. Frequent turnover doesn’t make things easier.

5/ The number of annual investor meetings is not necessarily an effective performance metric for IR. It's more efficient to measure potential buying behaviour following these meetings and use that data to offer additional time or management access where needed. For Patrick, this approach seems more of an art than a science. However, it's essential for every company, along with their IR and management teams, to determine the best way to address this critical aspect of investor relations.

6/ With regard to generative AI in the context of IR, Patrick believes it can support preparations for earnings releases and free up time to focus on what is most valuable—building relationships with investors and analysts. The main theme of the German IR Society conference this month is dedicated to AI.

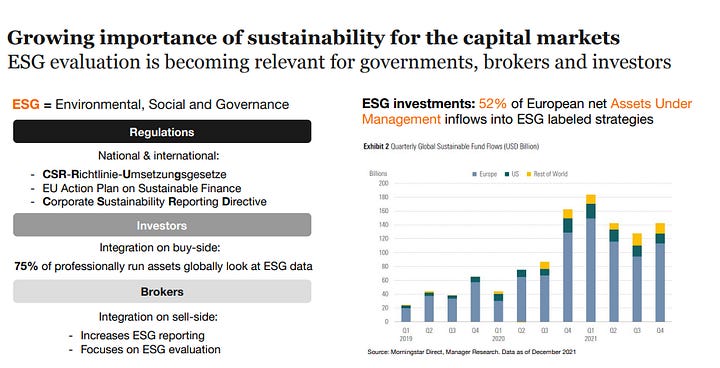

7/ One of the key functions of the ESG team within the IR group is to ensure that rating agencies accurately reflect the company's data in their scoring methodologies. Additionally, the team plays a crucial role in discussing ESG-related topics with investors, whose interest is increasing over time.

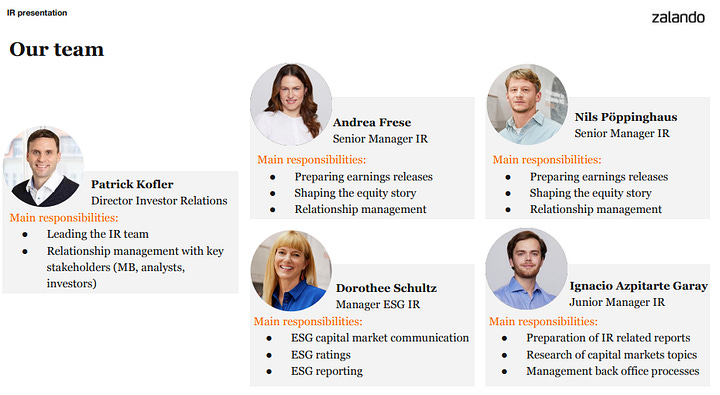

8/ Patrick’s team consists of 5 people, responsible for various areas including ESG, back office processes, research, earnings releases, and shaping the equity story, among others.