Last week, I had the privilege of presenting at the Turkish IR Society about evolving trends in investor relations. Since then, I’ve received several requests to share the presentation, so I thought it might be a good idea to write down and share a few of the things I shared with the audience.

First and foremost, I think any discussion on 'trends in IR' should start with the broader trends affecting listed companies’ primary audience: institutional investors. For emerging markets, where we spend most of time in, this includes dynamics unique to these regions. Beyond this, I thought it might be useful to touch on “bigger picture” technological trends—AI, blockchain, and the development of the web. While many of these may seem like buzzwords today, I believe the applications that they will bring about will, over time, change the landscape of the capital markets.

This is by no means an exhaustive list of developments in our industry. I have deliberately chosen not to cover topics such as reporting, governance, ESG and CSRD, MiFID II, and other areas that I know form a significant part of many people’s work lives! I’ve chosen to define trends broadly, focusing on areas that will shape investor relations as we enter 2025!

There is a lot to cover, so let's get started!

The Investment Universe

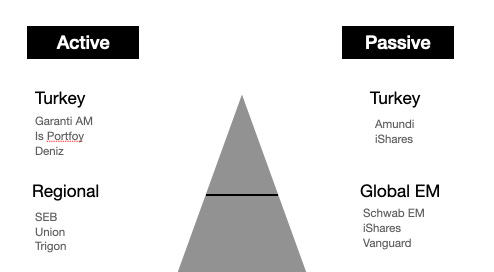

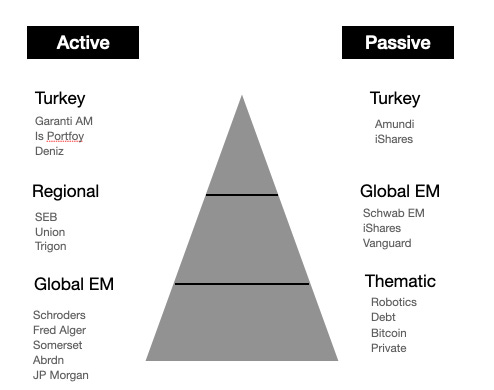

The addressable universe of investors can be thought of a two sided pyramids: one part representing active funds (managed by professionals who meet companies) and the other representing passive funds (which simply track market indices in a low cost way). In reality, there is also a bit of overlap between these categories. For instance, some institutions like Norges Bank, while being active investors, often behave passively due to their sheer size. Similarly, some firms like BlackRock operate in both active and passive spaces.

Emre Akcakmak from East Capital, who presented after me, highlighted a few dynamics in Turkey that also resonate across other markets, particularly in Eastern Europe: the decline of regional funds, such as those focusing on Eastern Europe—exacerbated by Russia’s exit from the MSCI EM index—and the rise of local institutions supported by private pension systems. Additionally, much of institutional investor behaviour, including inflows, is influenced by factors outside a company’s immediate control, such as its weighting in the MSCI EM index. Furthermore, even if a company falls within an investor’s universe, liquidity and market cap restrictions (many EM funds adhere to thresholds like a $1 billion market cap and $1 million daily trading volume) often prevent engagement. It’s no surprise, then, that a recurring theme at IR conferences is how to be more proactive and go deeper to reach incremental investors.

On the other hand, there has been significant activity in the world of exchange-traded funds. Many of us think of ETFs as simple index trackers, but a quick look at iShares’ directory reveals a much broader scope. There are actively managed ETFs (where fund managers aim to outperform benchmarks), thematic funds, and funds designed to provide access to niche areas of the market. Private market ETFs, though nascent, are beginning to emerge. ETFs cater to both retail and institutional investors, and the core debate vis-a-vis active funds continue to revolve around fees and performance. For example, an actively managed EM fund from Abrdn Asset Management costs over 1% per year in fees, while an EM passive fund from iShares costs only about 0.1%. Research shows that, on the whole, active fund managers struggle to outperform index trackers, which often achieve better results due to lower costs. Therefore, it's unsurprising that ETFs make up over half of trading volumes in many markets.

There’s an idea that revolves around proactively engaging the entire addressable investment universe, which management and IR teams could incorporate into their 2025 plans.

Addressing Active Funds: Companies can take on the role of their own "head of equity sales" by organising targeted, company-led events, such as roadshows, webinars, or dedicated investor days. These initiatives proactively complement traditional, reactive methods like broker conferences, and incoming calls. By actively engaging with the active investment audience, companies, over time, own the relationship with the buy-side and reach a broader pool of potential investors.

Addressing Passive Funds: A useful exercise, at least at the outset, would be to understand the investment methodologies and inclusion criteria of various indices a company could potentially join. This may involve analysing the rules and benchmarks used by index providers—many of which now consider factors beyond simple market-cap weighting—and exploring how the company’s profile aligns (or not) with these criteria. An interesting question to ask is "What sort of a company should I be to benefit more from passive funds"?

Tailoring the Message to Different Investors: Engaging with the addressable universe also requires tailoring the message to suit different types of investors. The approach or service provided to a new fund the company has never interacted with would differ from that offered to an existing shareholder. Similarly, the messaging should be customised to meet the priorities of a growth-focused fund versus one that prioritizes dividend yield. There are many creative ways to think about this, and AI tools will make it easier to execute such tailored engagement strategies efficiently.

AI

It has been over a year since generative AI took centre stage. While I haven’t been closely following all developments, I’ve noticed several key trends emerging:

New Model types : Generative AI is evolving beyond simple text-based interactions. New models (such as 'agentic' or 'multimodal') can not only respond to text prompts but also perceive and interact with their environments. For example, models are being developed that can see, hear, and even sense physical surroundings, paving the way for more immersive AI applications. Google’s DeepMind recently has showcased multimodal models capable of understanding visual and audio inputs simultaneously, such as identifying objects in images while responding to spoken instructions.

Hardware and Infrastructure: A significant portion of investment in this space today is focused on the infrastructure layer. Companies are racing to develop the hardware and cloud infrastructure necessary to support advanced AI capabilities. Nebius, among others, is building robust cloud solutions to optimise AI training and deployment. Instead of buying an NVIDIA’s GPUs remain critical for accelerating AI workloads.

Open Source vs Closed Source Debate: The AI community is divided on whether the methodologies and datasets used to train AI models should be open to all or remain proprietary. Open-source advocates argue that transparency fosters innovation and democratisation, while proponents of closed-source models emphasise security, intellectual property, and commercial viability. For example, OpenAI’s decision to release GPT-3 in a limited way contrasted with Stability AI’s open release of Stable Diffusion has fuelled this debate.

Ethics and Regulation: As generative AI becomes more pervasive, questions around ethics and regulation are gaining prominence. Governments and organisations are grappling with how to ensure responsible AI development while preventing misuse. As you would expect (!), EU is leading the way in this seeking to establish a regulatory framework to address these concerns, while companies like Anthropic are designing models with “Constitutional AI” principles for ethical guardrails.

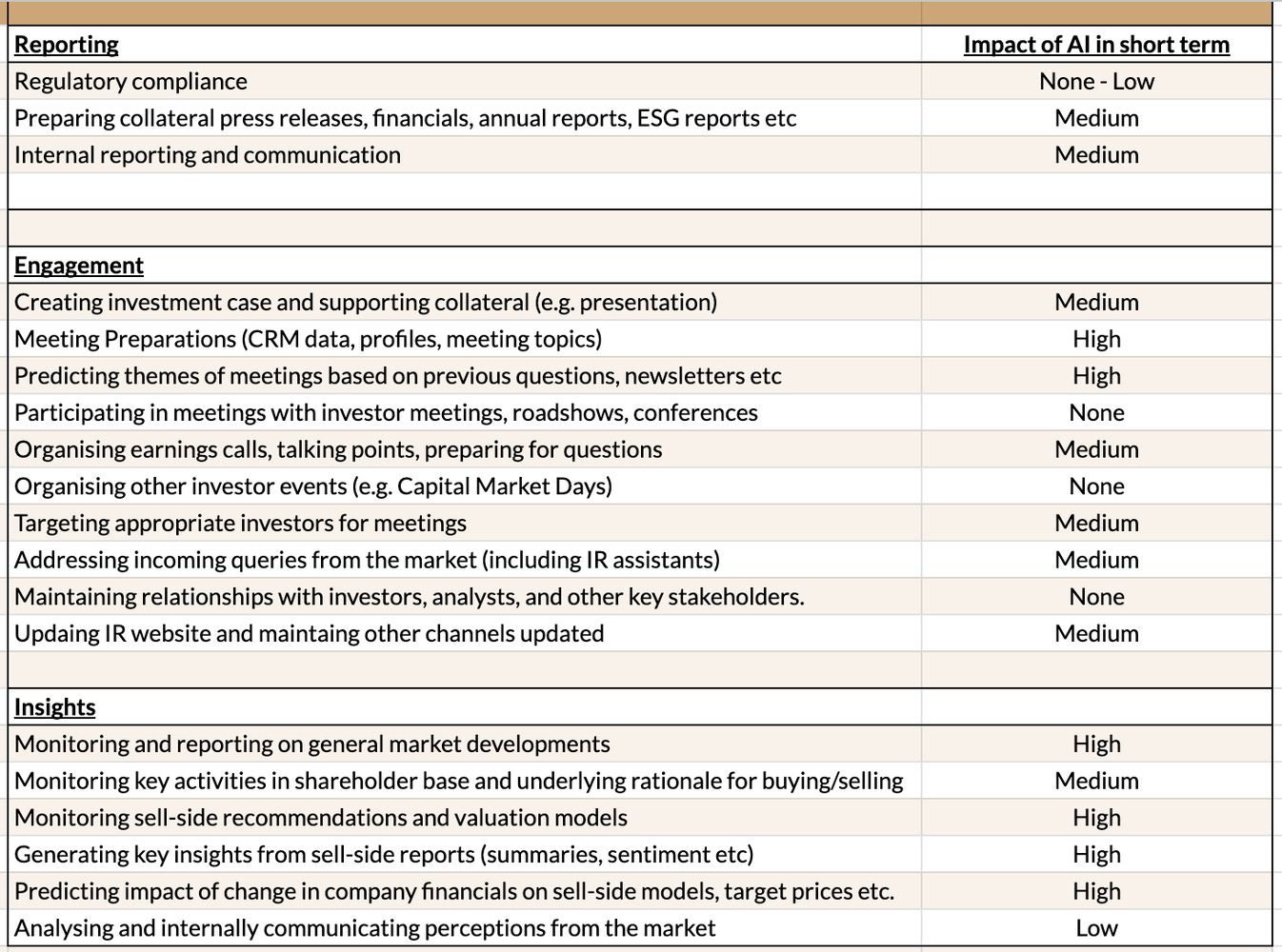

The obvious observation is that as these developments unfold, organisations will increasingly adopt these tools top down and integrate them into their workflows. For those of us in IR, these changes present opportunities for greater efficiency and doing a lot more with data. We’ve observed a growing number of companies fine-tuning language models and enhancing them with their own datasets. We’ve also been innovating in this space, and last year we launched CAI, a solution that leverages data from our platform while integrating it with internal sources for a more comprehensive approach.

Blockchain

While mainstream focuses on bitcoin prices, lawsuits, meme coins etc, quietly there is something happening beneath the surface— backbone plumbing for new financial system is being built. At its core, blockchain is as a verification mechanism for transferring value. Unlike traditional systems that rely on centralised institutions as intermediaries, blockchain enables value to move seamlessly and securely across borders without intermediaries. This decentralisation makes sending "value" as easy as sending an email with a photo.

Tokenised securities and stablecoins: One of the most relevant to us applications of blockchain is in tokenised securities, particularly debt or private credit instruments. By embedding various terms and conditions into smart contracts, these digital tokens can automate compliance, payments, and other processes, reducing costs and increasing transparency. Stablecoins—blockchain-based digital currencies pegged to stable assets like fiat currencies—are also becoming a crucial component of this ecosystem. They serve as a practical bridge between traditional finance and decentralised systems, streamlining cross-border payments, enabling faster settlements, and reducing transaction costs. Initially, we are likely to gain traction among smaller companies— ie the "left side of the adoption curve"—seeking efficient alternatives to traditional capital-raising methods.

(But actually...) anything that has value can be transported on these digital rails, almost instantaneously and at almost no cost. Things such as loyalty points, in-game currencies, carbon credits could be tokenised, traded, and utilised in novel ways. This provides companies with all sorts of creative tools to engage their customers and build loyalty and for investors, new asset classes to invest in.

Regulatory clarity: lack of regulations has kept DeFi largely on the fringes of the financial system. However, regulations under the Trump administration are likely to address this by establishing rules and frameworks to ensure that solutions entrepreneurs build using this technology are legally recognised.

As this ecosystem evolves in 2025, listed companies will be introduced to more creative tools to engage with their customers and retail investors, while smaller companies gain new, accessible methods to raise capital on-chain.

The ‘3D Web’

I intentionally avoided using the term “metaverse" due to its negative connotations and widespread misconceptions. However, the high-level concept remains: the future of the internet is unlikely to be confined to flat, 2D websites. Instead, we are moving towards a more immersive, three-dimensional digital worlds that blend with the real world, eventually creating an interconnected, layered experience.

I recognise that this is a simplified perspective, and it may take another five years—or more—before we can seriously consider the 3D web as anywhere near reality.

For IR teams, the 3D web will provide a completely new toolkit to engage with investors and tell their company’s story. Traditional formats like presentations and 2D websites will no longer be the main way to tell your story. Imagine instead offering investors an immersive virtual experience where they can explore your company’s operations, interact with key data, meet management in impactful and memorable ways. For example, an oil company could create an immersive experience allowing investors to explore their drilling operations virtually, bringing complex operations to life.

From my conversations with companies, the opportunity to use technology and stand out to investors and differentiate yourself from thousands of companies is appealing. Early adopters will have the advantage of shaping how this new medium is used while setting themselves apart as forward-thinking leaders!