Loyalty Token as an Asset Class

How blockchain based 'tokens' can provide a new toolkit for companies to engage their customers

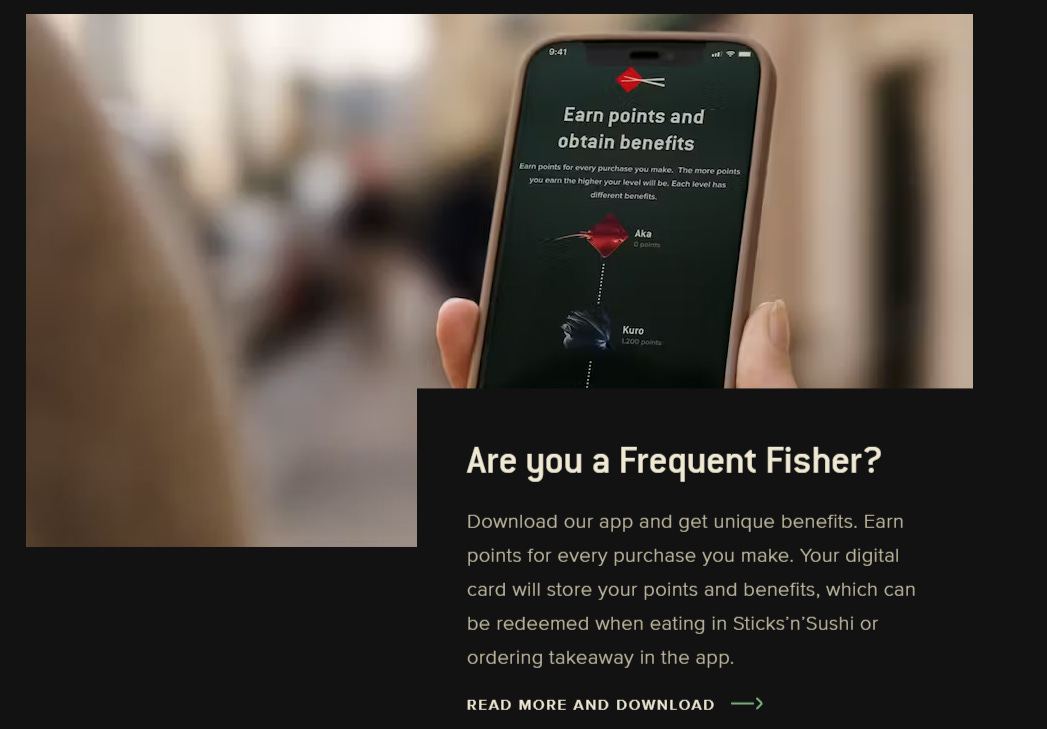

A few months back, we visited Sticks’n’Sushi in Berlin, a medium/high end sushi restaurant.

As we were leaving, a brochure advertising their loyalty program caught my attention, inviting me to download an app for earning points and unlocking 'unique' benefits. The idea seems clear: accumulate points through sushi purchases, akin to frequent flyer miles, and gain access to perks as you move up the food chain of frequent clients. A typical loyalty set up.

Why do loyalty programs feel so outdated? Are there more effective ways for brands to engage meaningfully with their customers? What are the problems with existing models?

I've rarely encountered truly innovative approaches to loyalty programs, especially in the context of capital markets1. Most of what we get today is a an overflowing email inbox filled with generic mass advertisements, announcements lost in a sporadic discount code.

So what exactly are the problems with the existing model2?

Firstly, right from the start, there's noticeable friction involved in downloading a loyalty app, creating a new account, adding yet another password to remember, and subscribing to more newsletters. The phrase “just leave us your email address” has become the price a customer pays to receive some day a discount from the company. The friction is more pronounced when brands interact with their customers across digital and physical ecosystems. Probably some level of friction might be necessary, but ideally, this should be seamlessly integrated into the customer touch points itself.

Secondly, ownership. The key issue here is that loyalty points often don't feel like they truly belong to me, the customer. Sure, they might be stored in an app under my name or on a website, but the company's changing rules can lead to them expiring or being purged back by for one reason or the other. If I move to a new country, I might lose access to them altogether. If I don’t fly British Airways, my points will be taken away. They don’t feel like an asset in the way a collectable card, an antique book, or a painting does.

Linked to ownership is the issue of transferability: I can't really do much with my points. I can't send them to a friend, sell them, auction them off, or use them as collateral. Importantly, there is no market for them, and I do not know what they are worth. They are essentially tethered to the brand, which, at some level, creates a psychological distance between me and the brand I'm engaging with. One could argue that the loyalty programs ‘work’ precisely because the company needs to be in full control of what it offers, to whom, when and for what in return. While those arguments may in certain cases be valid, I suspect that large part of the reasoning is that ‘it was always done that way’ or simply there was no obvious alternative.

Thirdly, and perhaps the real reason I didn’t feel compelled to download the sushi app and collect my 20 points, is that I'm hardly a regular at Stick’s 'n Sushi. I've only been there once and it might be years before I visit again. But I am a sort of a regular at other nice sushi places. It would be ideal if there was some kind of interoperability in place, allowing my sushi points to be recognised or accepted in other venues (perhaps a sister bar or a Japanese stationery store). However, I don't want to juggle 50 different loyalty apps, nor do I want to constantly figure out which brands are allied with each other.3

To sum up the main structural pain points are around onboarding and UX, issues around ownership and transferability, and interoperability. And I am not touching on new ideas such as using loyalty points to, say, access a virtual art gallery or learn to make tempura with the head chef.

It seems that the industry is calling out for an operating system of recognising value with a global distribution rail.

Tokenised Rewards: Turning Static Points into Assets

This operating system is a blockchain network that provides an asset-agnostic infrastructure for the transfer of value.

Once an asset (digital or real-life) becomes a ‘token’, it is handed a universal passport to this digital financial infrastructure.

It can have value and trade freely on a secondary market. Given this passport, the asset gains the freedom to move outside the gated farm, reaching a global audience, and enabling markets to determine what 10,000 Lufthansa tokens are actually worth.

The benefit for companies is that the rewards are far more likely to end up in the hands of customers who will actually redeem them. Higher redemption rates signal higher customer engagement. Secondly, and more crucially, brands now have a tech-based toolkit to develop direct relationships with their audience, something that has been ebbing away since the introduction of credit cards.

For customers, this means their rewards potentially sit in the same wallet (or ‘portfolio’) as, say, Bitcoin, stablecoins, or other tokenised financial assets such as equities, real estate, and alternative assets like art, vintage wine, or other loyalty ‘tokens’ from a portfolio of brands. It can be compared to a data file that can be sent across by email or WhatsApp (the asset-agnostic infrastructure I was talking about). Companies retain some control by programmatically coding the tokens so they behave in a certain way (e.g., all Lufthansa miles should err… expire in 2027).

And this is where it becomes interesting. Instead of loyalty rewards being a fringe benefit sitting in an obscure password-protected website, their prominence rises, emerging as an asset class in their own right and becoming a part of your clients’ ‘ownership portfolio’.

Key benefits for companies include a direct relationship with the customer and customisable tool for ultra stickiness, with a the ability to shape this relationship as desired, improving lifetime value.

Benefits for the customer include owning an asset instead of a point and engaging more meaningfully with the brand.

This infrastructure addresses, head on, the key issues we discussed earlier, creating an environment for a company to offer an integrated (offline and online) customer engagement experience. While the scenario above might seem a bit ‘‘out there’’ on the first reading, I'm convinced that the new financial asset stack will inspire innovative engagement strategies for creative brands and customers will finally become owners of the brands they love.

I also sometimes wonder why listed companies (who are also large brands) do not consider using shares to creatively engage with customers (or vice versa), especially in markets where there is a large culture of retail investing. For example, could a Tesco shareholder receive discounts or benefits simply for holding shares? I suspect one of the reasons is that the operational complexity of such would be very complicated. Considering the big layer of intermediaries involved, it is even a challenge for a company like Tesco to properly identify all of its shareholders, especially the retail ones. But it turns out they do!

I'm aware of the vast array of consumer behaviours and loyalty models present in various industries. To lump and analyse them together under a single umbrella would certainly not do them justice. But for sake of simplicity and to align with my own comfort zone, I'll focus this discussion on the the so-called points-based / tiered loyalty programs.

There is some success with airlines and hotel chains doing this. I catch myself in instances in choosing to fly Lufthansa over British Airways (even if it was more expensive) because of the former being part of an alliance where I had more 'points’ and closer to an upgrade.