Navigating the New Normal: Corporate Access in a Post-COVID World

Formats, differentiators and opportunities listed companies

A couple of weeks ago, I took part in a panel discussion about investor communications in a post-COVID-19 world. Discussions were broadly centred around how our industry is adapting to the new realities and what we can expect from the future.

After the event, I spent a bit of time reflecting on what was discussed. I thought it might be useful to share some of the key points we covered together with some of my own perspectives on the topics, as well as share one or two interesting case studies which caught my eye during the last few months.

Meeting formats and the meeting demand equation

Corporate access continues to be an important element of the decision-making process, even more so during times of increased uncertainty.

According to the recent survey* by BNY Mellon, despite the lack of in-person meetings during the pandemic period, the majority of active investors surveyed continue to place a high value on meeting company management and a fifth have it as a requirement before initiating an investment position.

In theory, virtual meetings promise companies the chance to reach many more investors without leaving their offices. In reality, the picture has been somewhat mixed.

Overnight the corporate access industry switched from being almost entirely face-to-face based (especially in key investment centres where there is no shortage of conferences and roadshows) to 100% virtual. During the early days of the pandemic, the number of meeting requests around the world shot up as investors scrambled to interrogate companies on their COVID strategy.

At the same time, virtual meetings instantly levelled the playing field - travelling and seeing investors face-to-face around the world was no longer a differentiator - and intensified the competition for capital amongst companies around the world.

With Asian companies comprising over 60% of the MSCI EM index (the most widely adopted performance benchmark for global EM managers), EM fund managers were understandably spending more time meeting management teams in China, Indonesia, India and elsewhere, a large majority of whom had historically travelled far less than their EM peers for physical roadshows and conferences.

A busy IPO market in countries such as Brazil and Russia left them even more spoilt for choice. It was perhaps inevitable that something had to give. 2021 has seen a more selective approach from investors; one of the main casualties has been the regular catch-up meetings which historically have taken place whenever a portfolio company is in town.

Our own data suggests that for companies that were organising physical roadshows 4-5 times a year in Europe, following the initial bump the level of demand for similar events in virtual format has actually declined in many cases. Meeting quality has at times also been called into question. In addition to this, the ease of rescheduling virtual meetings guiltlessly resulted with more no-shows. Anecdotally, many are eager for the return of physical meetings (advocating a ‘hybrid’ model going forward) and there is already some evidence of a cautious move in this direction.

Demand for this comes both from company management and IR teams who enjoy travelling and forging direct relationships with market participants, and from investors who feel they can get a better ‘sense’ of the company by looking into the whites of the CEO’s eyes or reading the body language of management.

Recent research* by Massachusetts Institute of Technology, China Investment Corp., and Remin University of China seems to support the idea that investors can better identify mispricing through in-person meetings with corporate leaders, with more meetings linked to higher stock returns.

The ‘hybrid’ model would enable active fund managers to take advantage of the innate convenience and efficiency of the virtual format, while helping them to maintain close ties with company representatives.

"Having those personal relationships really, really counts. And that actually helps you a lot in moments like March 2020, or 2007-2008. So in summary, yes, I am absolutely for the return to face-to-face, but I think we'll probably imagine it could be more of a hybrid world going forward, which hopefully for all of us means there's a bit of an efficiency gain that prevails." - Michael Todd, co-Head EMEA Equity at T. Rowe Price*

"For big capital markets days or regular results, presentations, online formats, absolutely fine. But when we're trying to get our heads around companies, you can't take away that sort of human connection. Bringing that human connection back through the latter part of the year and offering one-on-one meetings in whatever way would be really, really helpful."- Rachel Reutter, Senior Fund Manager at J O Hambro*.

This sentiment was also reflected by Matt Hochstetler, an equity portfolio manager at Capital Group at a recent conference in New York.

The IR Calendar as the Curriculum for long-term students of the company

Despite certain limitations, the virtual environment has provided companies with a new and potentially exciting angle from which to present their investment case.

Peregrine Riviere, Group Investor Relations Director at WPP and former Chairman of the UK IR Society spelt out the opportunity as follows:

“We are producing a series of webinars, open to all, diving deep into different parts of our business. Low prep, zero cost, easy to access, adding context and colour to the main thread of our investment story, and showing the strength and breadth of our management and client offering.”

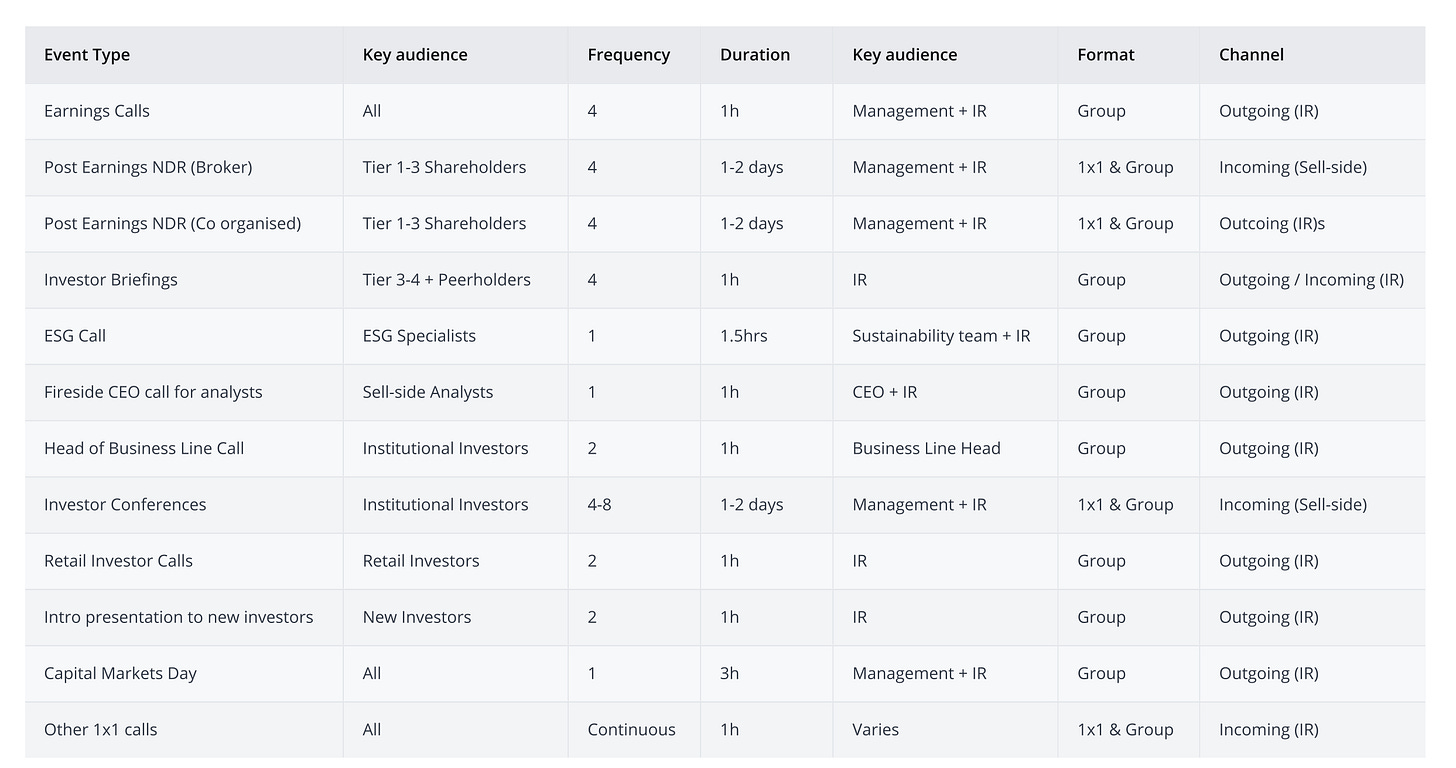

Examples of such events hosted by other companies include introduction calls to new investors, dedicated calls for retail investors, conversations with business line heads, CEO sessions with the sell-side and dedicated ESG analyst briefings.

The suitability of such events naturally varies from company to company, however there are sufficient case studies right now to suggest that they are being well received by the investment community.

I share Harry Schwefel’s, Co-Chief Investment Officer, Point72, view* that investors are long-term students of the companies and institutions they invest in, and meetings are educational opportunities for them to see different, and perhaps contrasting, aspects of the investment case. In his own words:

"I've seen some companies do a nice job of splitting up their teams and organising different types of events by various members of management. This is very well received by our investment professionals just because it gives more chances to become very good students of your businesses and the industries. Investment teams should have different views and dimensions of your business and where it is going next."

IR as Head of Equity Sales

One of the knock-on effects of MiFID II has been to shift much of the burden of responsibility for articulating and disseminating the company investment case from analysts and intermediaries to IR teams themselves. This has been a challenge for many, especially in the small- and mid-cap segment where resources tend to be thinnest.

A growing number of experienced equity analysts from investment banks have switched to IR in recent years, introducing welcome new practices and knowhow to our industry.

Based on the numerous conversations I’ve shared with those who have made that transition, I would say the top three skills these individuals believe they bring to the table as: 1) knowing investors and how they think, 2) being able to articulate the investment case and sound credible (not over-promoting the company), and 3) knowing how to translate and distill investors’ expectations internally.

As Tatiana Volochkovich, head of the award-winning investor relations team at VK in Russia, put it, a large part of the skillset she built up at Morgan Stanley was “knowing what investors are after in terms of disclosure/execution and trying to focus on these areas to maximise share price impact”.

Another key component of ‘knowing the investors’ involves getting to grips with the investment mandates of the funds, understanding the portfolio manager's level of familiarity with your company, and then tailoring the message and delivery accordingly.

A framework that considers internal resources, materials, channels and audiences might be a useful step in the IR planning process for next year.

It seems reasonable to suppose that our profession will continue its trajectory towards greater responsibility for IR teams, both in terms of the content and the distribution of their investment case. Of course, this presents both opportunities and risks. One can begin to draw loose parallels between our space and certain aspects of the decentralised internet architecture promised by the pioneers of the Web 3.0 movement. However, that is a topic for another post!

Case Study 1 : Thinking like our audience

Garanti BBVA’s IR website considers head-on the thought process of a top-down generalist investor, addressing macro (Why Turkey?) and sector (Why Turkish Banking Sector?) questions before articulating how the company’s own investment case fits into the picture. This is followed by an “investor kit” that offers both a catch-up kit and a comprehensive-kit for different audiences, depending on their level of familiarity with the company. This forensic approach to understanding your customer recalls Simon Sinek’s famous ‘Start with why’ TED talk, and is a great blueprint for IR teams wondering where to start with their own investment case.

Source: Garanti BBVA investor relations website

Case Study 2: Series of dedicated IR meetings for ‘new investors’

Logo Yazilim allocates time every quarter to host regular, company-organised roadshows specifically dedicated to meeting institutional investors they have not met before. The process involves targeting funds that have a mandate to invest in the company, that are already investing in the company’s peers but that have not yet had the chance to meet the company.

The format is a small, virtual, group meeting, led by a presentation from the IR team and followed by a question-and-answer session.

The article is editable by my network for the purposes of crowdsourcing additional thoughts and case studies. I will be updating the original post periodically.

Add your story or case study here.

----

References and footnotes

1- BNY Mellon’s paper 'Corporate Access Through COVID-19 and Beyond', September 2021.

2- See research paper by Eric C. So, Rongrei Wang and Ran Zhang titled ‘Meet Markets: Investor Meetings and Expected Returns’, September 2021

3- IR Society's ‘Meet the Fund Manager’ webinar, 9th February 2021, features discussion between a number of fund managers including Michael Todd, co-Head EMEA Equity at T. Rowe Price and Rachel Reutter, Senior Fund Manager at J O Hambro.

4- IR Magazine’s 'Meet the hedge fund: A fireside chat with Point72’s co-CIO’ webinar, 28th October 2020. Ben Ashwell, editor of IR Magazine speaks to Harry Schwefel, co-CIO, Point72 about investor relations and corporate access.