Proactive Investor Outreach

Data driven approach to targeting and engaging investors beyond the traditional model

This article is the second in a five-part series that explores key aspects of the investor relations function, including hosting earnings calls, investor targeting and outreach, IR websites, setting goals and navigating ESG topics. The aim of this series is to offer practical insights into how various aspects of investor relations are managed across the globe, with some insights and innovative nuggets and ideas that go beyond the basics!

When it comes to investor outreach, most publicly listed companies operate under a ‘reactive model,’ relying primarily on banks for investor introductions. This approach often becomes ingrained early in a company’s journey as a listed entity, starting with the IPO roadshow and continuing through broker-organised events and conferences.

As a result, many companies believe they are meeting investor demand by attending broker events and responding to incoming inquiries. To some extent, they are right—the universe of listed companies is well-defined, and any investor interested in, say, South African banks can easily identify a company by running a screener on Bloomberg and reaching out via the IR website.

Yet, there are compelling reasons to add a proactive component to your IR strategy. Relying solely on third parties limits access to only a portion1 of the addressable investor universe, often leaving untapped opportunities on the table.

For example, while investors in the “green part” of a pie chart can easily engage with a company by reaching out, they might not have done so yet. Some companies are finding success by reaching out to these potential investors directly2, increasing visibility through proactive engagement. This concept—equity sales for meetings, as brokers originally coined it—has gradually made its way into the IR world.

While the concept of company-initiated and organised roadshows is a novel one, many companies are starting to see the value in ensuring their investor coverage is as comprehensive as possible, while adopting a data-driven approach to confirm this. They can then sleep well at night knowing that no stone has been left unturned, that every investor with a mandate to invest in their company has either been met (via brokers or by directly), or at least has received an invitation to do so. This includes maintaining a dialogue with existing shareholders, but also proactively reaching out to institutional investors who are not yet shareholders but have the potential to become one.

Defining Investor Targeting

Investor targeting involves mapping out specific investors (or groups of investors) a company aims to engage. There are three noteworthy segments:

Existing shareholders – Both active and passive shareholders that are part of your shareholder register3.

Non-holders (potential shareholders) where you have a relationship – Institutional investors that are not part of your shareholder base but with whom you already have a relationship.

Non-holders with the mandate to invest in the company, but with whom you have no relationship yet.

When we talk about proactive investor targeting, we are typically focused on the last group.

Investor Types & Mandates

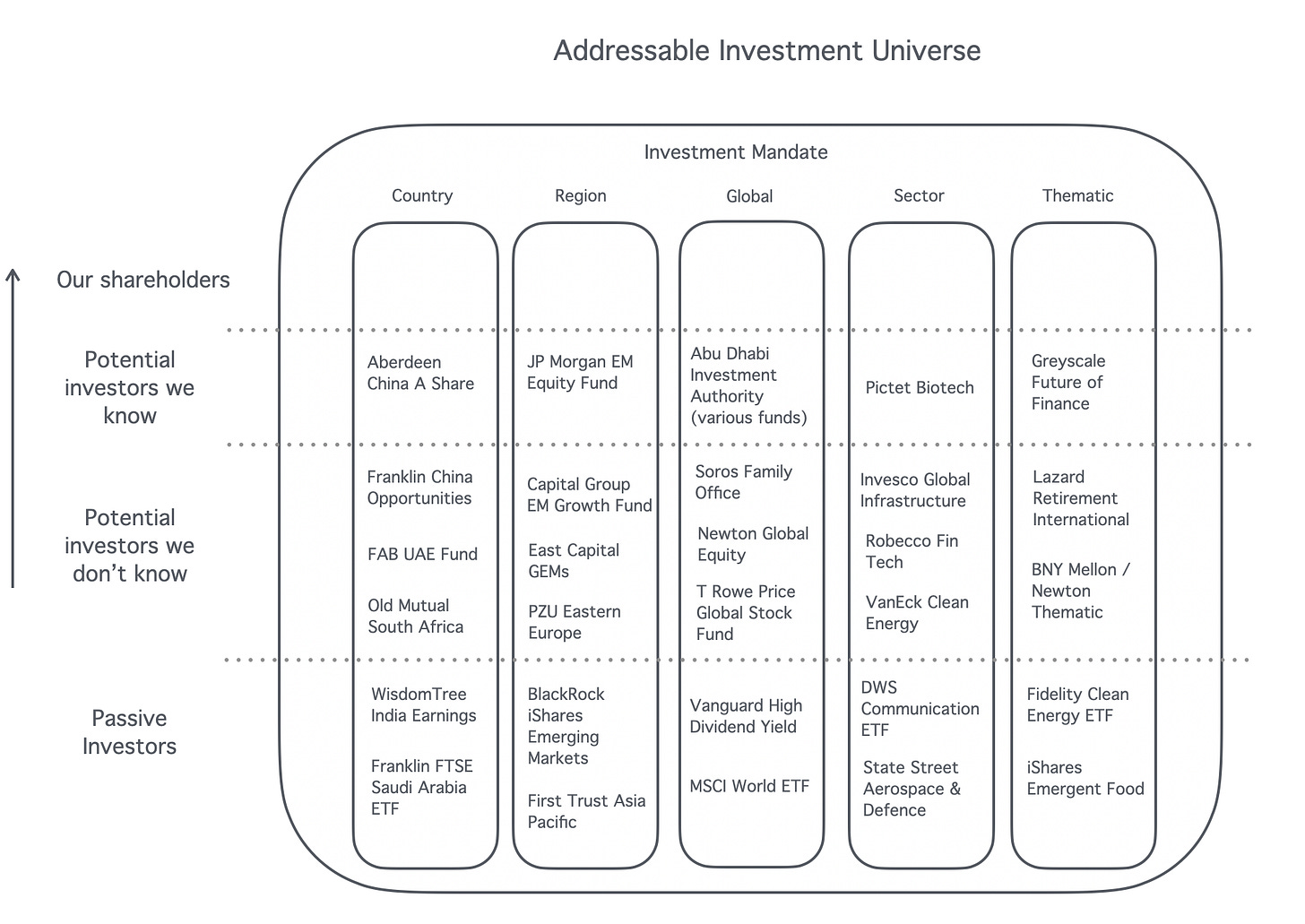

At a high level, public market investors can be grouped by whether they manage active or passive funds. While passive funds (like BlackRock’s iShares family of ETFs) generally don’t engage with IR teams, active funds—ranging from mutual funds to sovereign wealth funds—may be highly involved. Each investor group follows distinct mandates, which may dictate investments based on geographic regions, sectors, or themes, such as technology or demographic trends.

Several companies also find value in categorising these mandates and investor types within a visual framework. For instance, one approach might involve graphing them on a matrix, showing how different fund mandates align with specific investment themes.

Creating the short list: exclude and filter

A common approach for developing a shortlist from a long list of investors involves a mix of exclusions and filtering. Successful strategies often start by excluding investors who are unable to invest due to mandate restrictions. For example, a Brazil-focused fund will not have the flexibility to invest in an Egyptian company. After exclusions, applying additional criteria—like liquidity and market cap—helps further refine the list.

Companies may also explore methods like peer analysis, where they identify shareholders of similar companies and compare them to their own base. Another method is fundamental analysis, which reverse-engineers a fund’s investment strategy by examining portfolio metrics, such as P/E ratios or dividend yields, to find alignment with the company’s fundamentals.

Adding a CRM overlay to track past engagement can add another layer of insight. For some companies, these targeted lists are most effective when kept concise, perhaps around 100 names, which can then be expanded over time.

Outreach and marketing

Once the targeting is complete, companies can benefit from crafting a customised outreach plan. Many organisations structure their outreach around the quarterly earnings cycle, often adding company-organised roadshows. However, this outreach process isn’t always straightforward. An average institutional investor may have an addressable universe of thousands of stocks but only actively manage a few dozen.

Larger institutions often have teams that divide up sectors and regions, but the challenge remains: there is a small window to capture an investor's attention. Any given investment case is competing for attention with thousands of companies worldwide, making it impossible for investors to meet with every potentially interesting company. From our experience, several key practices can increase the likelihood of successful investor outreach:

It may seems like a basic point, but ensuring that the IR website is up-to-date—with a strong investor presentation, financials, and an IR calendar accessible within two clicks—goes a long way to build trust. When investment managers look up your ticker and land on your IR page, this will often be their first point of contact with the company. The quality of the IR website communicates the strength of the potential connection between the company and their upcoming research process, setting the tone for further engagement.

It’s worth taking the time to craft an elevator pitch and identify three to five key points that would attract a new investor to meet with you or management team. What makes your investment case stand out? Many companies include a few bullet points that go beyond the basic fundamentals, emphasising elements of your company’s unique story or growth prospects. Some companies even create multiple versions of their investment case elevator pitch. For instance, if the company pays high dividends, it would talk up this aspect when approaching dividend-focused investors.

Large investment firms often have hundreds of team members, with dozens working on a single fund. There are significant differences in roles—from analysts to portfolio managers—so it pays to research who is responsible for what and send the meeting invitation to the right person. Additionally, in the post-MiFID II world, many institutional investors have specialised teams dedicated to handling corporate access invitations and investment research from the sell-side.

Lastly, it’s a good idea to keep track of any feedback received during outreach—whether it’s a reason for lack of interest, availability conflicts, or other responses. This information, while not always consistently provided, can be invaluable for refining future outreach efforts. Ideally, investor targeting and outreach is an ongoing process, not a one-time event, and each interaction can offer insights that improve the effectiveness of the next round of engagement.

Putting it All Together

Proactive investor outreach is ultimately about ensuring that a company’s story reaches the right audience. Many companies are finding that by taking a direct approach, they not only broaden their investor base but also deepen relationships with investors genuinely aligned with their vision. Building a structured, data-driven outreach strategy allows these companies to feel confident that they’ve reached as wide an audience as possible, cultivating connections with those who recognise and believe in the company’s potential.

Naturally, the extent that this statement is true will vary company to company and market to market, and there will be cases where the reverse holds mostly true; e.g. in very niche segments of the capital market, that the intermediately does indeed have access to the vast majority of the addressable investment universe.

The meeting between a management team and a portfolio and analyst to discuss the company, industry, investment case etc. are a core component of the investment decision-making process, and in some cases, this meeting is a requirement before an investor takes a position.

Identifying shareholders in public markets is not 100% straightforward. For example there might be cases where an investor says they are a shareholder but there is no way to be 100% sure. Today’s system of shareholder identification, with a thick layer of intermediaries has flaws.