SME Financing 2.0 : A Look At The Micro Connect Model

Exploring the Potential of Daily Revenue Contracts in Emerging Markets

In a previous post, I explored the challenges of fundraising and the limited tools available for raising capital, particularly for small and medium-sized enterprises (SMEs).

Thanks to a conversation with Ralf Kubli, I was introduced to an innovative product being pioneered by a company called Micro Connect on a large, country wide scale. In short, Micro Connect operates a financial market platform that connects micro and small businesses in China with global investors through something known as Daily Revenue Contracts (DRCs). The founder of Micro Connect, Charles Li, is a highly respected veteran of the financial markets in Asia, known for his decade-long leadership at the Hong Kong Stock Exchange and his tenure at the helm of operations in China for several large investment banks. Last week, I had the privilege of meeting and hearing firsthand from their team about their business model and future plans and felt excited enough to share a short summary of what they are working on.

The most significant innovation at Micro Connect, I believe, is the creation of a new asset class that blurs the lines between equity and debt crowdfunding and addresses some of the challenges that exist in traditional equity crowdfunding model. The asset class itself lives within a comprehensive infrastructure designed to sustain this novel fundraising technique. Both are worth taking a closer look at.

How do DRC’s work?

Consider a bike repair store needing extra storage space to cope with an increase in demand and requires $20,000 to expand its premises. Obtaining this funding from banks would more often than not prove to be a challenge. The store's size, risk profile, or arbitrary conditions like having a foreign shareholder would often disqualify them from getting meaningful funding. Another option would be equity crowdfunding (or similar), but this often involves relinquishing some control and lacks a functioning secondary market for private equities. Moreover, such businesses typically don't plan for further funding rounds or exits so these schemes seem a bit out of place. Other common methods such as peer-to-peer lending, venture capital, invoice financing, trade credit etc. all exist but are siloed geographically and only applicable to a small percentage of businesses1. What about the hundreds of coffee shops, bakeries, dance studios, supermarkets, bookshops that do not get off the ground because of lack of access to funds?

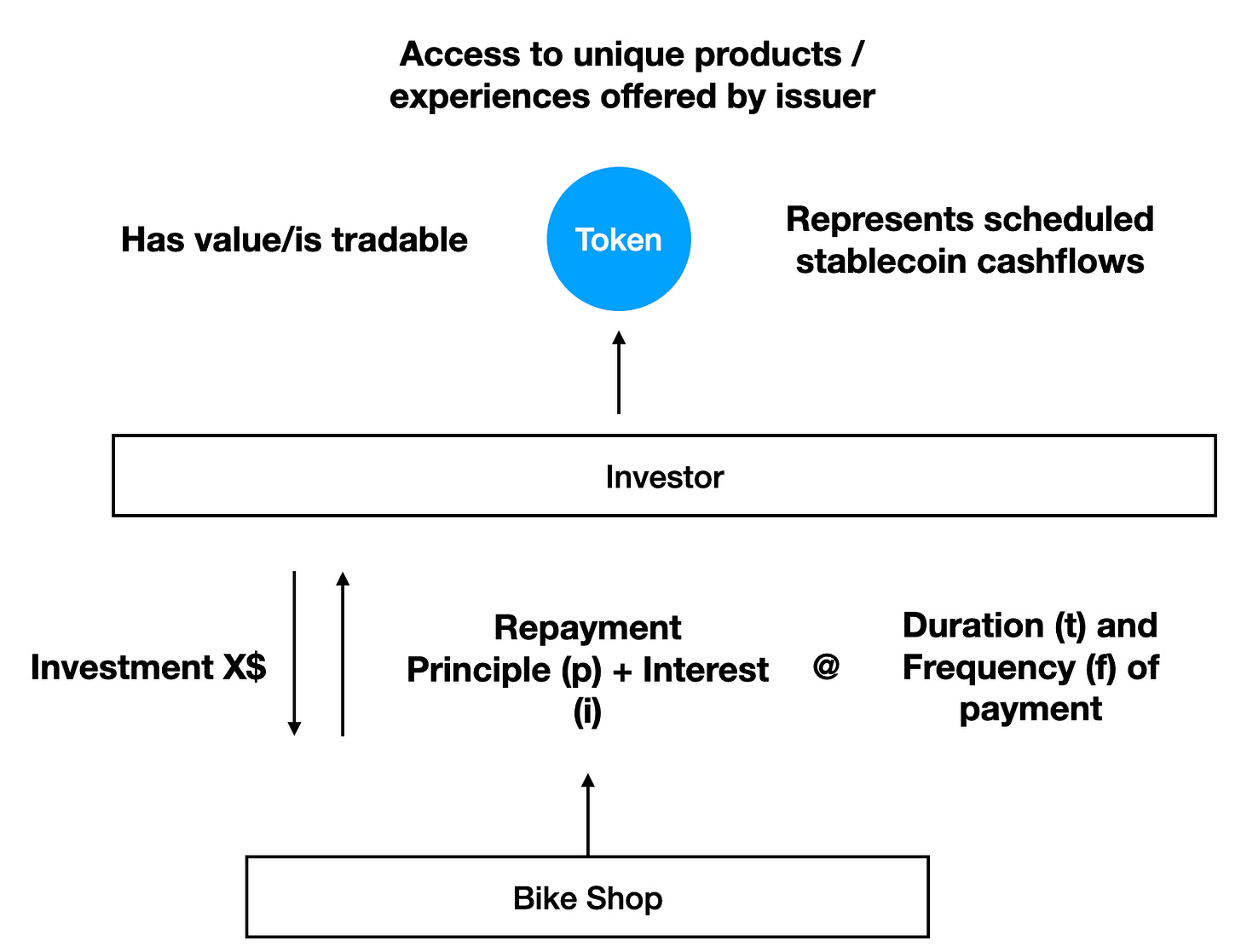

Enter the DRC… Under this model, our bike shop receives the required funding from investors and, in return, agrees to repay the debt back daily — a small percentage, say 1%, of their revenues, for a set period. This would be akin to the store paying a credit card transaction fee with each purchase. Each day, the financial institution that manages payments for the bike store, electronically processes the store's revenues, calculates the owed sum, and transfers it back the investors. This process repeats daily until the full investment is repaid, plus a bit longer. The repayment period is designed to cover both the capital invested and provide an additional upside, effectively creating sort of a hybrid of debt repayment with an equity-like component on top.

Micro Connect, the DRCs pioneers

Micro Connect is pioneering the DRC model at scale in China, and specifically within industries where it sees need for their product largest, such as such as food and beverage, retail, culture & sports, and services. Over the last couple of years, it has deployed over $150m across thousands of stores across China.

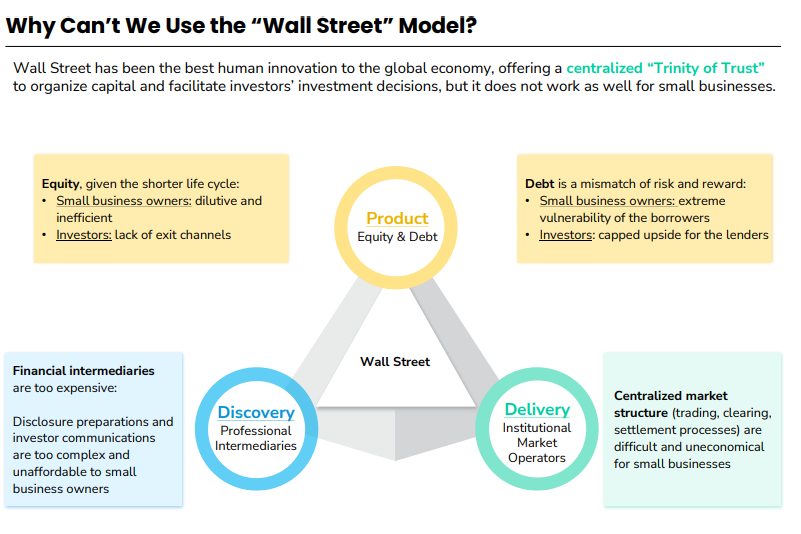

The key advantages of DRCs over traditional equity crowdfunding include immediate payback/returns for investors without waiting for an exit event, while still providing some of the upside later in the instruments lifecycle. For businesses, it means retaining control without dilution from external, potentially inexperienced investors. This product does not fit neatly in the traditional model, as one of Micro Connect’s slides highlights:

But Micro Connect is doing a lot more than just facilitating a new fundraising model. Having raised almost half a billion dollars, they are now integral across the entire ecosystem, which I see as resting on four key pillars:

a) Micro Connect as an Investor: Micro Connect actively seeks out high-quality, independent non-chain stores in need of capital and invests in them directly. The average investment per firm is around $50,000, creating a diverse income stream that helps mitigate risk. Many of their success stories, showcasing the impact of these investments, are featured in a dedicated section on their website.

b) Micro Connect as an Infrastructure Provider: Micro Connect works with the electronic digital financial system, a concept perhaps (still) very specific to China, to ensure that the 1% daily revenue is accurately identified, collected, and appropriately redistributed back to the mothership. This involves developing proprietary tools for reliably accounting for these cashflows as well as operating their own Macau based exchange, MCEX.

c) Micro Connect as an Investment Product: Micro Connect pools these contracts together and offer them as a bundled investment product to qualified investors. They also operate their own exchange in Macau, where these instruments are traded, adding a layer of liquidity and accessibility in compliance with accounting and regulatory norms.

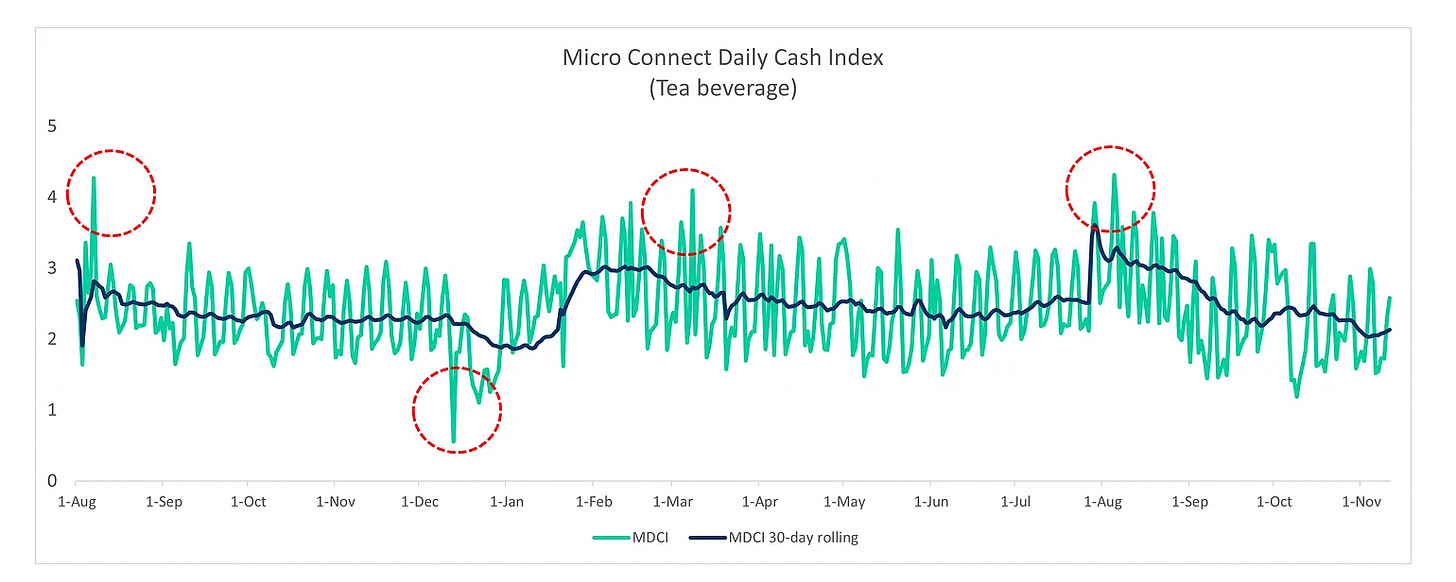

d) Micro Connect as a Data Provider: In the process of managing these contracts and investments, Micro Connect gathers a wealth of data that could be valuable to investment managers, banks, and other players in the financial ecosystem. They offer a glimpse into sort of datasets through their own

newsletter.

In essence, Micro Connect is not just a facilitator of the DRC model; it is a comprehensive ecosystem architect. From direct investment to infrastructure development, product creation, trading and data analysis, it is redefining the landscape of small and medium enterprise financing in the second largest economy globally. This multidimensional approach not only empowers businesses but also creates a new paradigm for outside investors looking for a diversified, real-time return. This seems to be part of the vision, to make it easy for an investor in, say Zurich to take part almost directly in China’s investment story.

Where do we go from here?

An intriguing aspect of the company's articulated forward plans refers to the intention to “launch a blockchain-based market platform enabling traceability of every yuan to facilitate the sale of DRCCs”. While they acknowledge that it is still early in this process, I could envisage two clear benefits of introducing Web3 into this model.

Back Office: Clearing, and Settlement for Millions of Daily Payments: Web3 stack could improve the way daily payments are managed, and move away from a depending on centralised counter-parties, thus reducing the need for intermediaries and potentially speeding up the process. Thus the process of clearing and settling potentially millions of daily transactions can be streamlined. offering more efficient, transparent, and possibly secure system. A number of smart people are already working on solutions to make this a reality, for example NYALA with their smart bond.

Front Office: Broadening Access Through DRC Tokens: Currently, access to individual contracts or Micro Connect’s broader financial products is limited to qualified, approved institutional investors, especially those looking to trade in Macau. This limitation can be substantially alleviated through Web3. By tokenising DRCs (either individually or bundled), they can be made accessible to a much wider audience via the asset-agnostic financial market stack that is Web3. Each token would represent a share of the daily revenue contract's cash flow, and this cash flow equation could then be standardised algorithmically and built into a smart contract, perhaps with the help of a framework like ACTUS, which aims to standardize contract types, bringing uniformity and clarity to each token’s projected cashflows. This not only broadens the investment universe for these contracts but also adds a layer of flexibility and, potentially, liquidity.

Engagement and Direct Relationship: The token could also offer certain loyalty benefits to holders. For instance, the bike store discussed earlier could offer a nice perk, for example an opportunity to customise their new electric scooters to all (DRO) token holders. The trend of companies having a narrowing and unified engagement approach to customers, investors, and token holders is one that I will certainly come back to and one that provides plenty of room for ideas and creativity.

Bringing it all together

In summary, the innovative model spearheaded by Micro Connect shows a significant vote of confidence in the DRC as a relatively new SME fundraising tool. It is fair to say that both the tool and the company behind it are still in its nascent stages of the development. If they are successful, it would presents an intriguing potential for broader applications in diverse economies outside China that share similar characteristic (for instance India or Indonesia) and ideas of how DRC’s could be used outside of the Micro Connect ecosystem elsewhere.

The DRC instrument also offers a compelling alternative to traditional methods, especially in areas where conventional funding models fall short. The involvement of Charles Li, a seasoned financial markets expert who has likely witnessed numerous fundraising ideas further underscores the credibility and promise of this approach. Additionally, and further out, the integration of Web3 technologies could enhance operational efficiencies and global reach of DRCs, as tokenisation of financial instruments becomes more prevalent.

Overall, Micro Connect’s model, with its unique blend of technology and financial innovation and ecosystem development, is certainly one worth watching in the evolving landscape of SME financing.

Thanks for reading!

This is not to say that Micro Connect automatically offers grants to everyone immediately. There are minimum requirements and a risk management process in place. However, the barriers to receiving this funding have been notably lowered compared to other means of raising capital.