The Rise of the 'Investomer'

Competitive advantage through a unified retail investor x customer approach

I still remember one of my first trips to New York when, during a taxi ride into town, the driver was discussing Amazon's latest earnings conference call. He shared his excitement about upcoming developments in the Marketplace product and expressed his belief that the company's shares were still undervalued. It's not every day you hear conversations about such topics in cabs in Europe or elsewhere for that matter. To my surprise, later that evening in a bar, I also overheard a related conversation between two bystanders. It occurred to me that talking about the stock market amongst everyday people in New York was actually 'a thing.'

Of course, the participation and engagement of retail investors and their interest in the stock market vary across the globe. In some regions, like the Middle East, retail investors constitute a large portion of stock market volumes, and in others, such as the United States, there's a strong culture of retail investing either directly or through their pension plans. Over the years, new tools have allowed retail investors, to some extent, to level up with professional investors; easily accessing data, research, and executing trades themselves.

Many of the listed companies that attract retail investors are ones whose products are used and loved by people every day. These investors are often the brand's most loyal customers, putting their hard-earned money into the belief that these companies will thrive. They talk about them to their friends, write about them online, and are naturally incentivised to come back and buy more stuff. In some cases, they even create somewhat of a cult-like following.

However, aside from a few global corporations, most companies don’t pay a lot of attention to retail investors. Investor relations departments, tasked with engaging retail investors, often lament how many of them there are, dismiss them as relatively uninformed, or accuse them of treating the stock market like a casino. Of course, it is a lot more rewarding to speak with Fidelity’s portfolio managers together with your top management.

Conversely, most companies don’t proactively cultivate meaningful relationships with their customers. Loyalty programs often have a tedious ring to them, and brands frequently resort to just maintaining promotional email distribution lists that you are automatically slotted into after making a purchase. For companies that do have formal loyalty programs, CEOs often don’t spend too much time on them, and their place being a line item tucked within the liabilities section of the balance sheet, often too small to make a relevant conversation topic.

Perhaps one reason is that companies don’t focus on this because of the perception that customers will come and buy their products anyway. The logic goes that resources would be better allocated to attracting new customers rather than investing to ensure they return. However, no business can thrive on customers who constantly switch, and research points out that keeping an existing customer is a lot cheaper (and more profitable) than acquiring a new one.

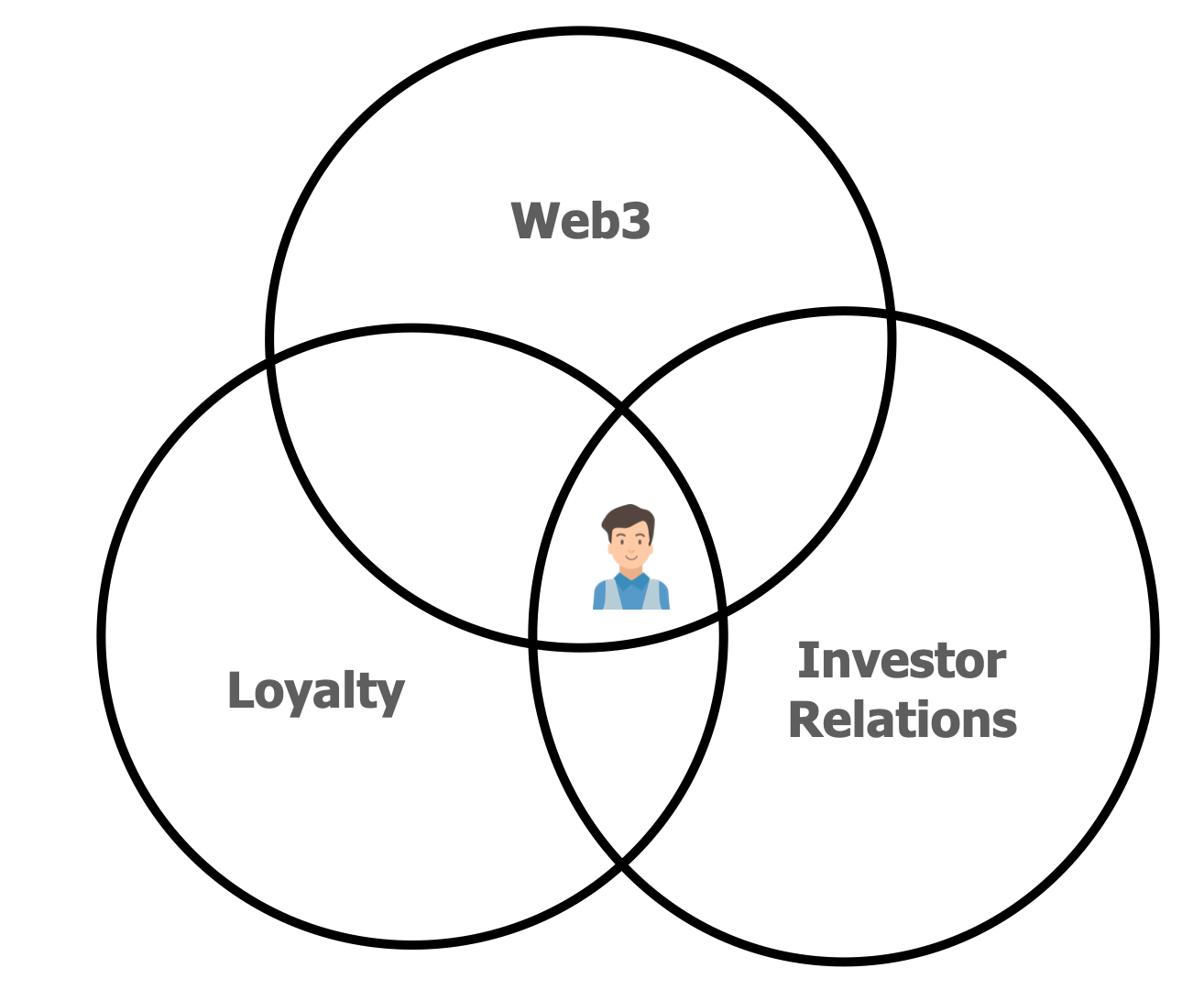

It strikes me that there is a gap and a natural opportunity for companies to nurture these relationships VIP investors and clients, or so-called ‘investomers’. Those are the individuals who discuss the brand with friends in the evening, browse your new product catalogue before going to bed, and check the share price first thing in the morning.

Giving those individuals attention would provide companies not only stronger ties to their customers but also a long term competitive advantage that no one talks about today.