Charles Lyle, the GS Head of Corporate Broking and UK ECM, recently shed some light on the changing dynamics of IPOs and the investment landscape in London and this lead me to share a few of my quick thoughts on the subject.

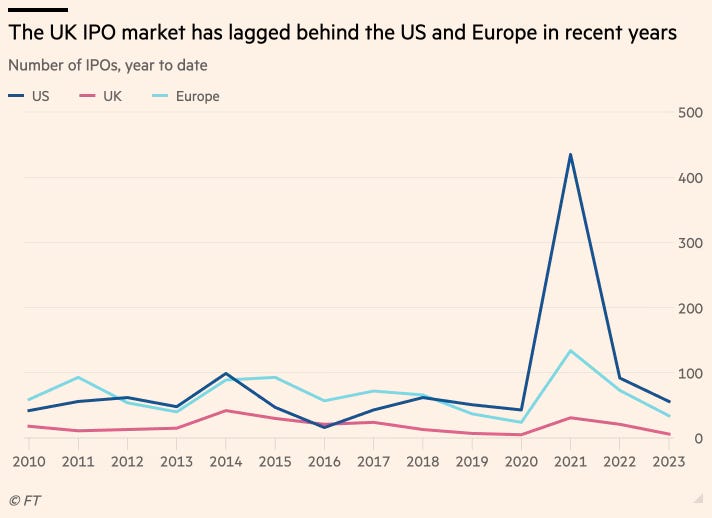

The backdrop: In recent years, the London Stock Exchange has experienced a stark 40% fall in IPOs, and more worryingly: numerous high-profile listings have opted for New York listing instead.

In his interview, he points to several factors contributing to this shift:

Rise of Private Equity: The landscape of the asset management industry has transformed over the past decade. Notably, private equity now claims a much larger share than it did 12-13 years ago. A look back at the years 2005, 2006, and 2007 reveals that more than half of the IPOs during this period were companies raising between $100-250m, which interestingly is the current sweet spot for private equity.

This reminded me of a recent article Craig Coben, former head of ECM and BoA, recently wrote about the purpose of IPO significantly evolving:

”At one level, it doesn’t matter too much if companies eschew London as an IPO venue. After all, the purpose of an IPO has changed. It used to be for raising growth capital, but nowadays companies can tap the ever-growing private pools of capital, such as venture capital, private equity, family offices and sovereign wealth funds. Today, IPOs are designed as much to enable pre-IPO investors to take money off the table as to raise new money. This means that IPOs don’t offer the same public benefit that they used to. Why should the public care how a private equity firm exits its investment? Moreover, you can have a robust financial sector without a bevy of IPOs. Singapore is growing its market share and burnishing its credentials as a financial centre, but its stock market is an IPO backwater. Australia has a robust equity culture with nearly half of superannuation (retirement) funds invested in stocks, and yet there are very few IPOs of significant size.”

This is a theme will be coming back to.

Shift in Investment Focus: ‘Growth’ companies have become the apple of investors' eyes over the last decade. However, the spotlight on these companies has predominantly been in the US rather than London.

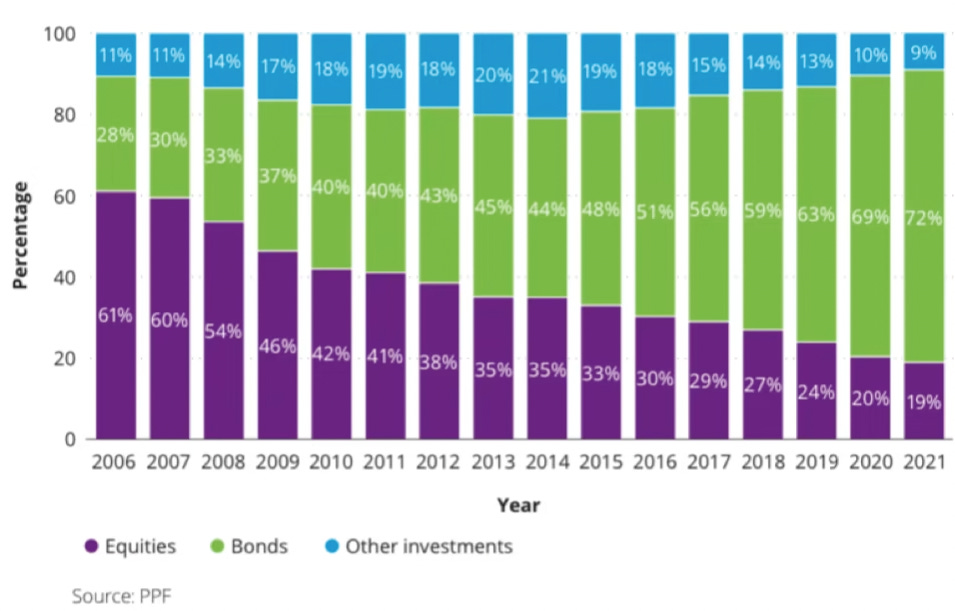

As an aside, another point worth making is that, as the chart below says, the percentage of pension and insurance companies that invest in equities have continued to fall, with the benefit going to fixed income. This has also had a large impact on liquidity of the equity capital markets.

Governance Anomalies: Governance has taken a frontline role in differentiating investment venues. This is evident not only in how investors perceive these venues, but interestingly, also in the voting recommendations set forth by entities like ISS and Glass Lewis that are influenced by listing venue.

Reforms: There is a flurry of listing reforms underway ik UK, and countless committees that are examining the attractiveness of LSE as a listing venue. The general perception is that these reforms, put all together, may turn out ‘positively’ in reshaping the investment environment.

As noted above, biggest impact would likely be if policy thinking would be oriented around incentivising pensions, insurance companies and retail investors (12 per cent owners of UK equities) to allocate a greater part of their portfolios to equities.Economic Epicentres are Shifting: While London and New York remain key players in the IPO market, the global economic centre of gravity is gradually drifting eastward. The momentum and vitality can be observed in the Chinese, ASEAN and Indian economies, where wealth is anticipated to grow exponentially. However, it's noteworthy that the institutional and pension markets in these regions remain in their nascent stages.

A Global Investment Theme: Lyle envisions the continuation of global investing as a theme. He foresees institutions in the West increasingly deploying capital in the East, leading to an even more fragmented capital market structure.

My personal view is that, the debate over the listing venue will soon become irrelevant as investors worldwide gain the ability to invest anywhere. Instead, companies will shift their focus to 'raising awareness' about their investment story, targeting a global audience of increasingly savvy (and independent) investors.

Interesting read!