What Could a Tokenised Stock Look Like?

Can Blockchain remove the final barriers to a truly global securities market?

At a recent investor conference in New York, Coinbase CFO Alesia Haas revisited the topic of the company exploring the idea of ‘tokenising’ its stock on the blockchain, currently listed on Nasdaq.

If it were to happen, what would it look like?

Depositary Receipts 2.0

The idea of tokenising equity in the broadest sense is not entirely new—it goes all the way back to 1920. At that time, if you were a U.S. investor and wanted to trade stocks in the UK, you had to trade directly on the London Stock Exchange. This was difficult for American investors; different regulations, settlement procedures, and currency risks made it challenging to own stocks directly.

To solve this, JP Morgan and Bank of New York worked together to develop a mechanism allowing U.S. investors to buy shares of UK stocks. This system was called depositary receipts (DRs) —a bank would hold ordinary shares in London and issue a receipt in the U.S. representing those shares, allowing investors to trade this receipt on a U.S. exchange in U.S. dollars.

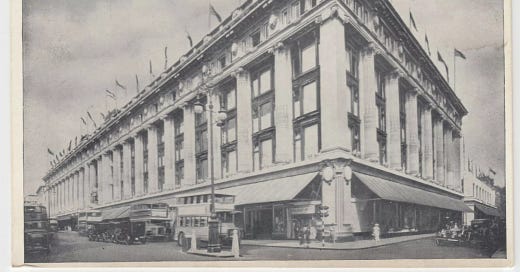

The London department store Selfridges was the first to issue Depositary Receipts in 1920. A Selfridges receipt behaved like a U.S. stock, trading alongside other US names such as General Motors, Chrysler, and Bethlehem Steel.

Fast forward to today, the challenges that existed 100 years ago to invest locally still to some extent exist today. As a result, the DR business has grown significantly over the past 100 years, with over a trillion dollars in assets now held in depositary receipt form by thousands of issuers. This has provided investors with easier access to global equities, including those in emerging markets. The DR product was particularly valuable there —not only was accessing an emerging market exchange tricky, but the local infrastructure often wasn’t ready to handle large IPOs.

DRs created a wrapper that made it easier for investors to hold shares of foreign companies in a way that resembled U.S. equities. They retained all the traditional features of their home markets—regulatory compliance, trading, settlement—while giving investors the stamp of approval and comfort they sought.

What is a tokenised equity?

A tokenised equity is fundamentally different, but in some ways, it is very similar to a depositary receipt— acting as a ‘wrapper’ of an underlying asset and making investment access broader and more efficient.

At its very core, tokenisation upgrades the traditional ownership record system. In today’s capital markets, buying and selling shares requires a complex web of intermediaries—brokers, clearinghouses, custodians, transfer agents, and settlement systems—all working to ensure that ownership is correctly recorded and transferred from one investor to the other, in a trustful way, preventing fraud and ensuring transactions are valid. This system was refined over decades and for better or worse, it works: trillions of dollars of transactions are being processed by this system each day.

With blockchain, this trust mechanism provides the trust but is automated. Instead of relying on multiple third parties, ownership is recorded and transferred via an online ledger and contracts, which are programmed and execute transactions transparently and securely. The blockchain itself acts as a source of truth, using cryptographic validation and consensus mechanisms to ensure every transaction is legitimate—without the need for intermediaries.

This shift brings two major benefits: lower costs and a better user experience.

Cost savings come from the fact that tokenisation eliminates many intermediaries involved in traditional markets, reducing fees for issuance, trading, and settlement. Transactions also benefit from instant settlement, clearing in seconds rather than days, which minimises counterparty risk and delays.

For investors, this could mean that stocks could be traded 24/7 and, in theory, be accessible to anyone with an internet connection—offering an experience similar to shopping online1. Once I own a share, I could import it into any ‘wallet’, an advisor’s interface, or an analytics platform. This opens the door for a wave of new apps that help manage, track, and analyse portfolios. In a way, it untethers your asset from a single broker or custodian, giving you much more control and flexibility.

For companies, this unlocks a major benefit: access to a much broader pool of potential investors, with significantly lower barriers to entry. Instead of being limited to institutional investors or retail traders in a specific country, companies could tap into a global audience—anyone with a smartphone and a wallet. Investors wouldn’t need to go through the traditional hoops of setting up brokerage accounts, converting currencies, or navigating local investment regulations. It also opens the door to new forms of investor interaction, loyalty programs, or even governance participation—all enabled through programmable securities.

There’s also potential for improvements in secondary market trading. Liquidity is a long-standing challenge for small- and mid-cap companies, with many struggling to attract enough daily trading volume to meet institutional requirements. While it’s still very early days, blockchain infrastructure could enable innovative mechanisms like automated market makers (AMMs) or continuous trading pools, which may offer new ways to improve liquidity and market efficiency for traditionally overlooked issuers.

The road ahead

Despite its promise, there are major hurdles ahead.

The first one on the list is regulatory. Today there is a lack of clear regulatory frameworks for tokenised securities that would enable this model to work on a global scale, especially within the public equity space. Traditional equities are subject to strict local securities laws, including listing requirements, disclosure rules, and investor protections. In contrast, tokenised equities today exist in a sort of a legal grey area—they can be classified as securities in one jurisdiction but as unregulated digital assets in another.

In essence, equity markets operate under local laws, while blockchain lends itself (or excels) in a global, borderless infrastructure—creating a mismatch between how assets are regulated and how this technology is designed to function. Until this gap is closed, the full potential will remain largely untapped.

Secondly, there are heavy product issues that need to be addressed. Will tokenised stocks be fully fungible (like DRs) with their ordinary shares traded on stock exchanges, allowing holders to redeem digital tokens for actual shares, or will they exist as separate financial instruments? How will voting rights be handled? Dividends and corporate actions also introduce all sorts of logistical hurdles—would tokenised stocks automatically distribute dividends, and how would companies manage stock splits, rights offerings, or mergers in a blockchain-based system? What about investor protection, custody arrangements, asset verification (relationship between the digital token and underlying equity), the list goes on…

Parting thoughts

My optimistic self believes tokenised securities will happen—it's just a matter of time. If history is any guide, tokenised securities will continue to evolve and coexist with traditional markets, as the regulatory and product-related questions I raised above are gradually addressed. I know people working on ambitious projects today that tackle these challenges.

For investor relations teams, this is an exciting space to watch and take part in —and potentially a major opportunity for company management teams in the near future.

Open question if this is a good thing or not! Subject for another day…

Great Post @michael

Just want to emphasize that in a country like Germany this is already happening - the regulation that is needed exists. :)

Same in Italy and Spain. The next challenge is to harmonize these national frameworks across the EU