When an exchange stops being an stock exchange

Reflections on London Stock Exchange Group Capital Markets Day 2023

One of the first meetings I had when I started working in banking was at the London Stock Exchange Group (LSEG). It was a meeting with a delegation of companies, regulators, and banks from Lebanon. Over the preceding ten years, the London Stock Exchange had established itself as the go-to marketplace for emerging market companies to raise capital from international investors. Many large privatisations from the Middle East, Russia and Africa chose London as their ‘capital market’ home, visiting the capital at least four times a year for roadshows and events. The London Stock Exchange's more credible listing rules and corporate governance code gave investors reassurance that they were dealing with trustworthy companies that fit into the mandates of funds they managed. Consequently, an industry of advisors, lawyers, accountants, research analysts, brokers, and investors of global institutions decided to place their emerging market teams in London.

Over the years that followed, many emerging market stock exchanges and local regulatory regimes have caught up and matured, and institutional investors have become more comfortable investing directly in these markets. Thus, the necessity to have a London listing as the only route to market has diminished. On top of this, a number of other factors have led to a decline in primary market activity.

LSEG, like many exchanges, has continued to evolve since its humble beginnings in 1698 at Jonathan’s Coffee House, where John Castaing began issuing a list of stock and commodity prices called ‘The Course of the Exchange and other things’. Adding new product lines, venturing into different asset classes and monetizing data was a recurring theme.

“We may even lose money on execution if we were to really allocate costs,” said Jeff Sprecher, CEO of NYSE parent company ICE in 2019. “And how do we make the money? Data, listings, connectivity, information… everything around the execution is where we make money.”

Despite all of this, I was taken aback to discover that equity trading now constitutes only a very small percentage of the total revenues at the LSEG. In fact, the group’s marketing video shows that the LSEG is no longer particularly about London nor about trading stocks.

I tuned into the company’s investor day to find out more.

The event spanned one and a half days, commencing with high-level presentations by the CEO and CFO, offering insights into the company's financial status and strategic direction followed by dinner. The second day delved deeper into specific operational areas with presentations and breakout sessions, focusing on Data & Analytics, Capital Markets, Post Trade, Data & Feeds, Workflow and Analytics, and Transformation.

Throughout the the two days, the board highlighted three main themes to the investors :

1- The position of LSEG as a global 'data company'

The first part of the discussions focused on the synergies and goals achieved following the Refinitiv merger, highlighting how well-positioned the group is to be a global player in the financial data and analytics field.

David Schwimmer, CEO had this to say:

“In 2018, LSEG was a collection of great assets largely focused on Europe, largely focused in terms of execution, on equities, and an important but relatively niche provider of data and analytics. Today, we are a leader in multiple asset classes, including fixed income and foreign exchange, which are the two largest traded asset classes. And we are a leader in data and analytics on a global basis, so that’s a significant shift.”

Back to equities... only 4% of LSEG's revenues come from 'equities trading', which means a decrease from 15% in 2017. Even Tradeweb, their OTC platform for fixed income, earns four times more.

Senior executives saying that listings are 'really not what the business is anymore' marks a huge evolutionary change.

There are many reasons behind the low number of new IPOs and the decline in the number of companies listed on the London floor. For instance, a few major British entities, like Arm, have chosen New York over London. Currently, stock exchanges face strong competition from 'easier' financing sources. Companies can obtain financing from the banking market, venture capital/private equity markets, and as the case in many European countries benefit from a significant influx of available state money (such as grants, shields and subsidies). And as a listed company, you have to fulfil a lot of reporting obligations, present your business transparently (also to all your competitors!), and face a spectre of potential penalties if you do something wrong.

Additionally, British pension funds have been showing less interest in investing in stocks. There's also a debate about retail investors who, thanks to the easy access to trading platforms (e.g. Revolut), opt for the NYSE/Nasdaq market, especially for technology companies and 'alternative' assets like cryptocurrencies. Efforts like the Capital Market Industry Taskforce, led by LSEG, are being made to revive the culture of investing in stocks. However, it will take a considerable amount of time before any significant change is observed.

Within the the City, there is a vocal group of people (and perhaps a smaller one in Westminster) who disagree with this concept. As far as they are concerned, the 300-year-old London Stock Exchange should be the absolute center of all City activities, even if the numbers clearly indicate that this is no longer true and ‘data’ is the new game in town.

2- High quality income profile

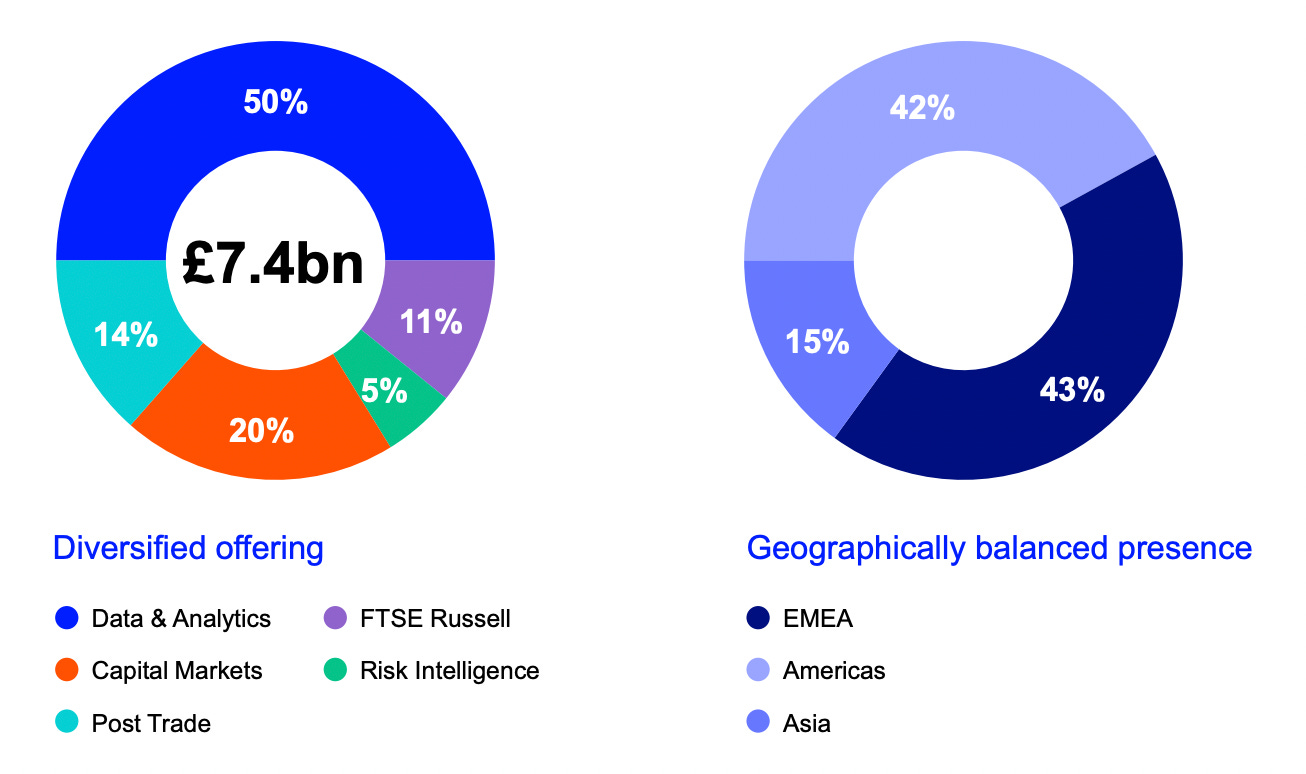

In brief, it looks like this:

Out of this, about 75% of revenues come from 'recurring subscriptions', with the majority of 'transactional' revenues being derived from Post Trade and Tradeweb.

In summary, the LSEG is actively shifting its focus away from trading/clearing fees, as these are highly susceptible to market fluctuations. Instead, it's emphasizing revenue from data and indices, which are more stable sources, as traders require information regardless of macroeconomic conditions.

When the acquisition was announced, management promised revenue growth of 5-7% per year, which it has delivered. The strategy seems to be well received by the market. Since the acquisition of Refinitiv, there has been a noticeable uptick in LSEG's relative valuation, particularly when compared to other global and European exchanges.

3- Collaboration with Microsoft

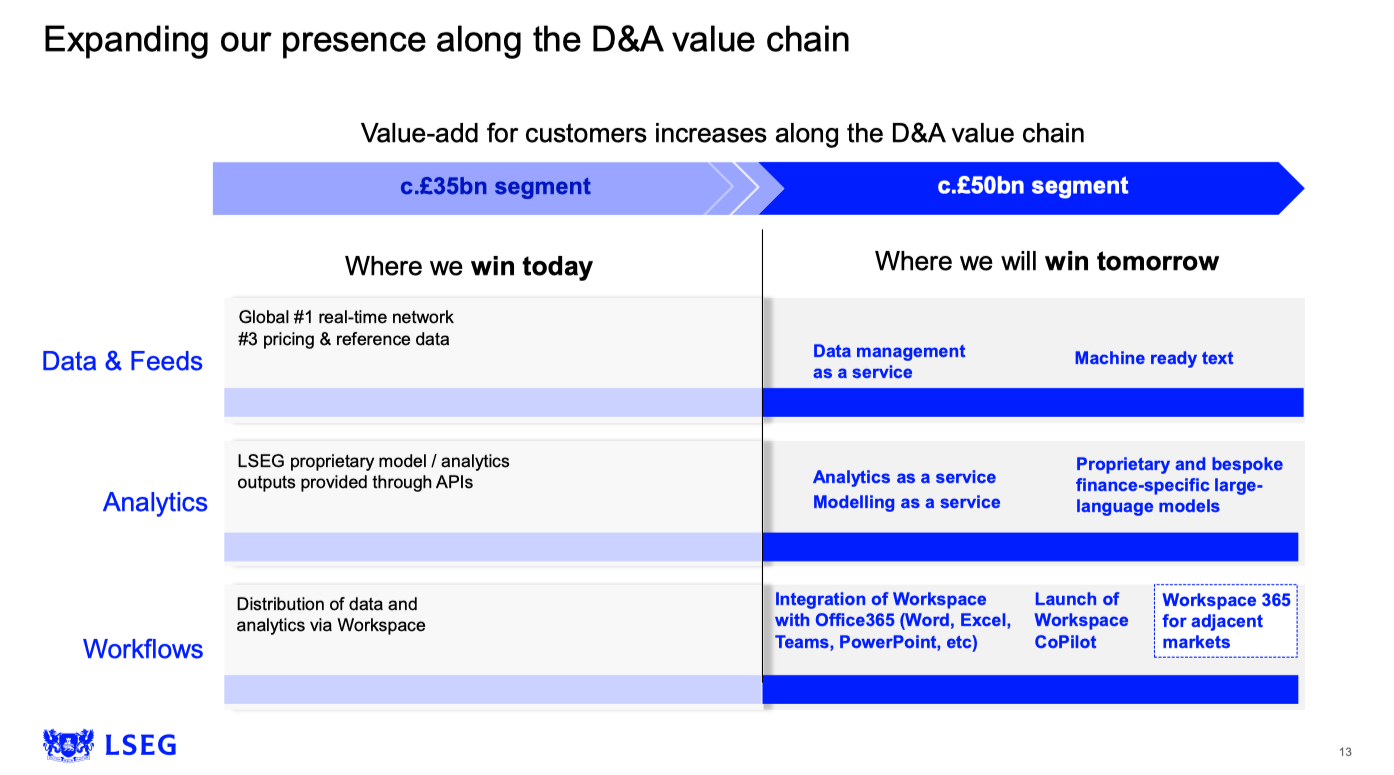

In late 2022, LSEG entered into a partnership with Microsoft to develop, among other things, an analytical product that has the potential to compete with Bloomberg. Simultaneously, LSEG acquired a 4% stake in the venture. This move is in line with some other similar developments, such as Google's partnership with CME, Amazon's collaboration with Nasdaq, and Adenza's involvement with NYSE.

LSEG anticipates that the pilot phase and general availability of the new product that it is collaborating on with Microsoft will be launched in 2024. This will include, among other features, the initial elements of interoperability in the 'Workspace' product and the early implementations of 'Analytics as a Service'. Additionally, the migration of applications and databases to the new Microsoft Azure cloud environment is set to begin in 2024.

There will also be an "model as a service" type app store, where users can share and use financial models. Embedding data and workflow into the existing MS productivity suite (Teams, MS Office, etc.)

The integrated data processing capability being built in the MS cloud environment should enhance the usability of LSEG data and create opportunities in areas such as Generative AI. Microsoft is a 49% shareholder in OpenAI.

Bill Borden from Microsoft:

“Instead of publicly using OpenAI’s ChatGPT, institutions want to create an environment where they can access and bring in [large language models] into [their] environment and control the data structures around that so you’re not losing your control around data, you’re not training anyone else’s model”

From an organisational standpoint, the event was a master class in investor relations organised capital market days. Plenty of access to business line heads, well laid out presentations from various divisions, demos, and plenty of time for Q&A.

Reflecting on all of this, it is evident that LSEG is undergoing a significant transformation, redefining its role in the ecosystem. Moving beyond its traditional focus on equities trading, it is positioning itself as financial data and analytics heavyweight and through Refinitiv, offering datasets far removed from its equity trading business.

Partnerships, like the one with Microsoft, are steps towards a completely new future where global data, not trading, is not something you look up but increasingly integrated directly into workflows.

With 300 million+ of Microsoft Teams users worldwide, many more people may yet be introduced to the joys of financial data on the fingertips soon.